Features of the Income Amplifier Tracking System

Tools for Epic Wealth Students, Alumni, and all Fynanc Hackers

In this post, I list many of the features of the Income Amplifier Tracking System.

Seeking Testers

I am seeking testers from the Epic Wealth group. I have a few folks from my own Epic Wealth accountability group that has been running for 2 years and a few others interested. If you are in the Epic Wealth program, and you are running your LOC Tracker successfully, then my system might be helpful.

To learn more, contact me directly.

Features of Income Amplifier Tracking System

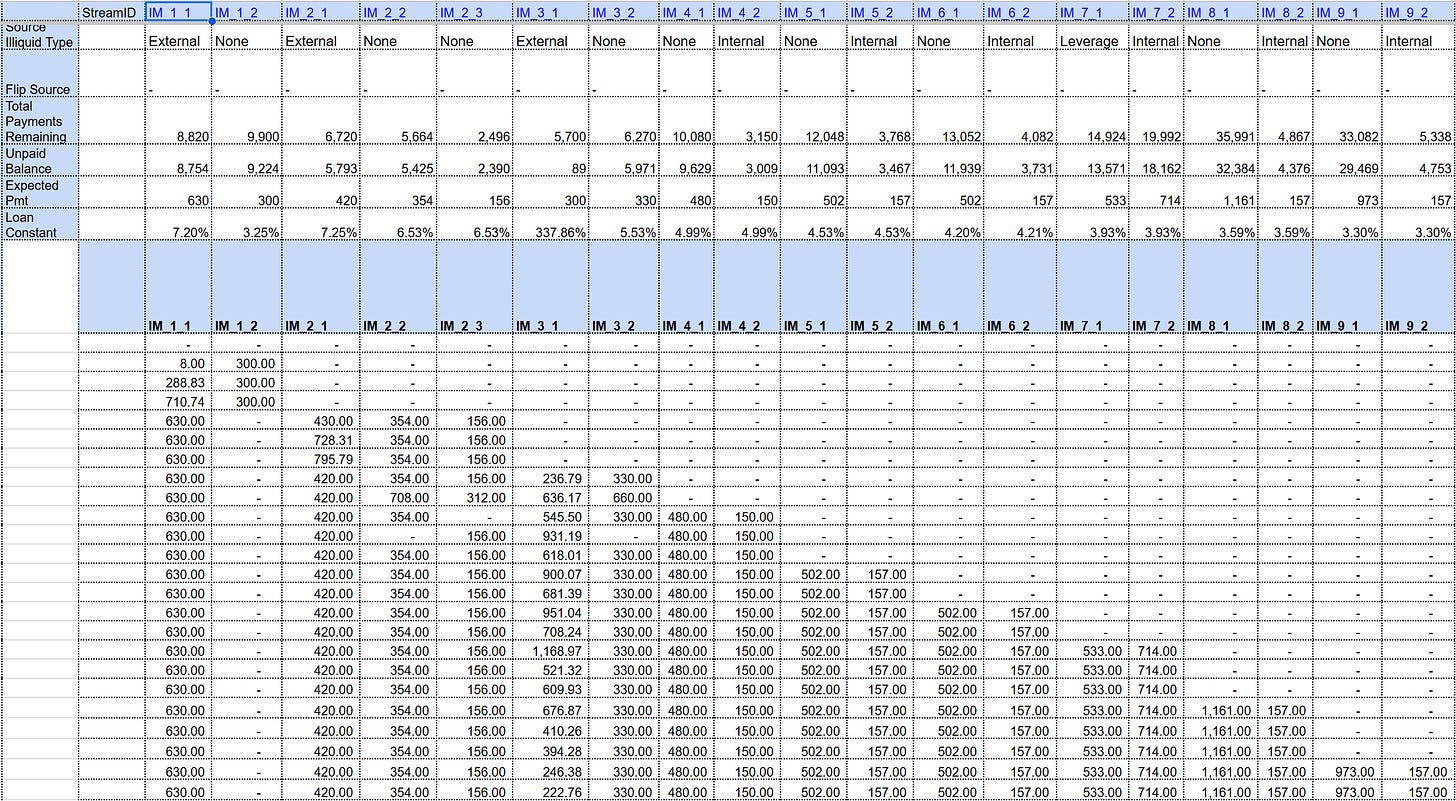

Tracking for Each Income Source

Unique income stream identifier for each income source

Invested Amount

Income source type (external, internal, liquid, illiquid)

Supports multiple income sources for each flip

Supports funding of an income source split across 1-3 credit lines

All the expected things: dates, term, interest rate (cash flow rate), payment source,

Notes for transfer process, investing process, and more

Report tab for each income source: all characteristics, current status, payments received, unpaid balance, expected and actual amortization schedules

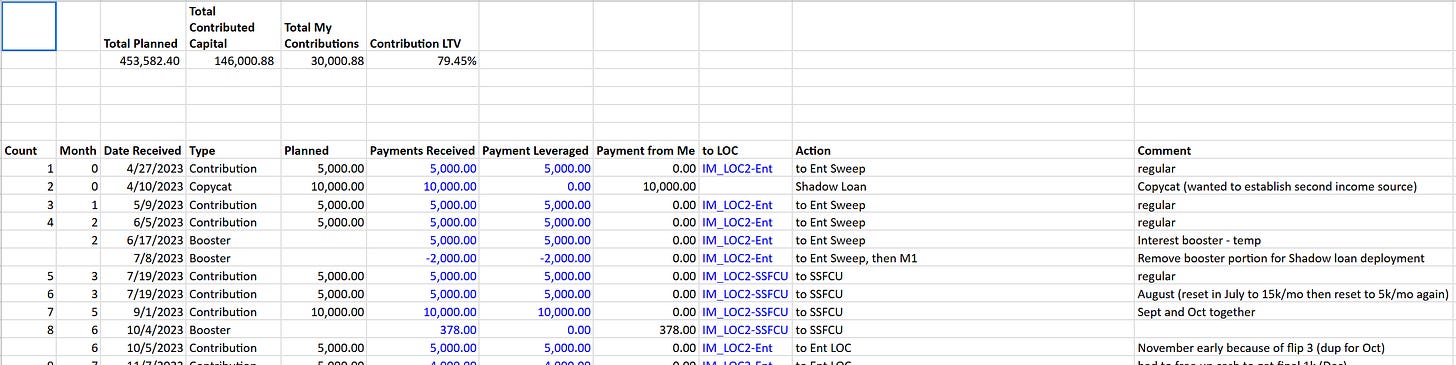

Tracking for Contributions and Boosters

Includes what you would expect: contribution and booster payments received, dates,

Supports 3 credit lines - so specify which payments go to which credit line

Supports leverage of contributions and boosters - if you borrow to make contributions or boosters, then it tracks the difference between contributed capital and your capital. (I did this because the main source of my contributions from the beginning was policy loans).

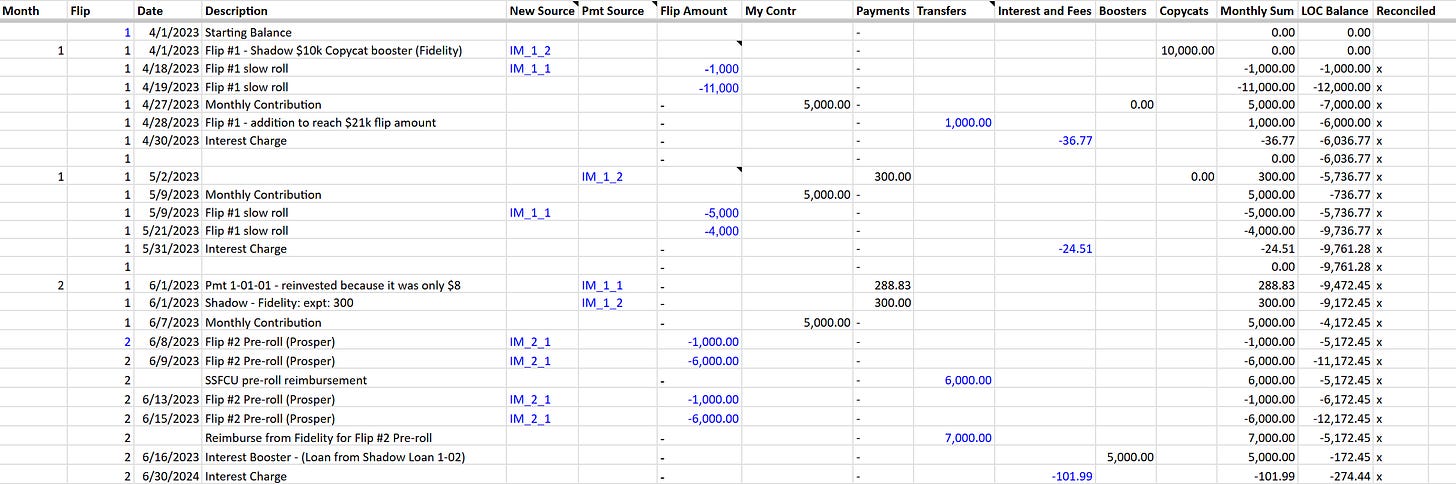

Payment Tracking

All payments for all income sources are tracked on one tab.

Tracks expected payments, too

Line of Credit Tracker

Line of credit tracker for each of 3 credit lines.

Pulls the data from other tabs, so you don’t have to enter data twice.

A summary of all credit lines together is kept and reported

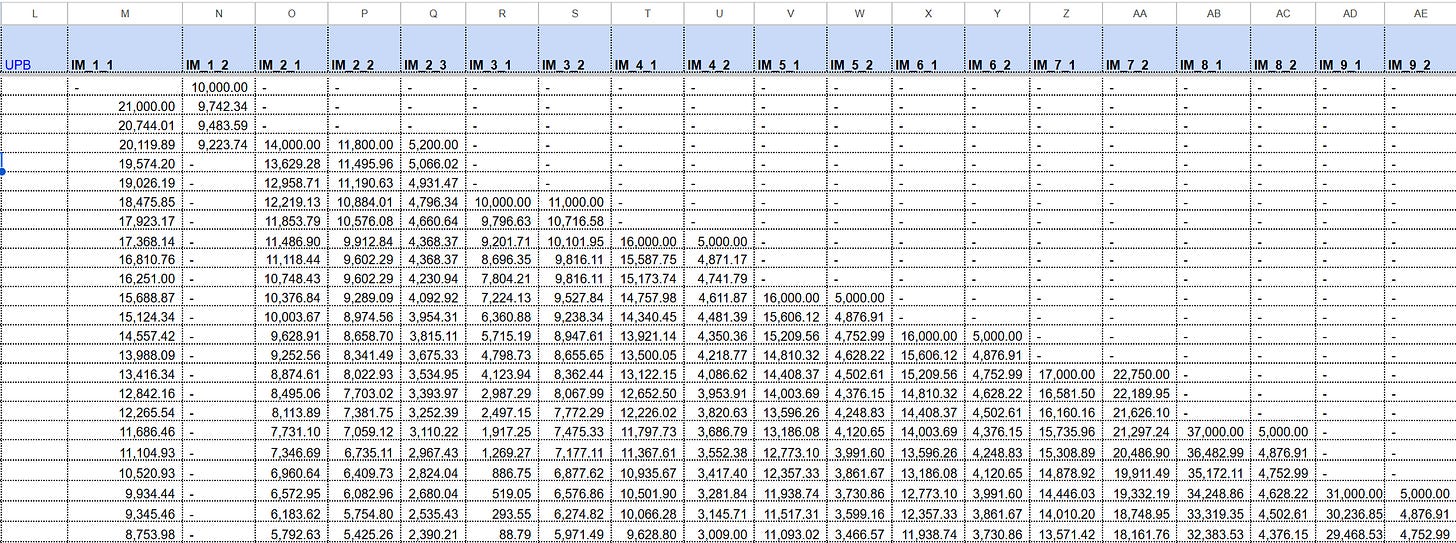

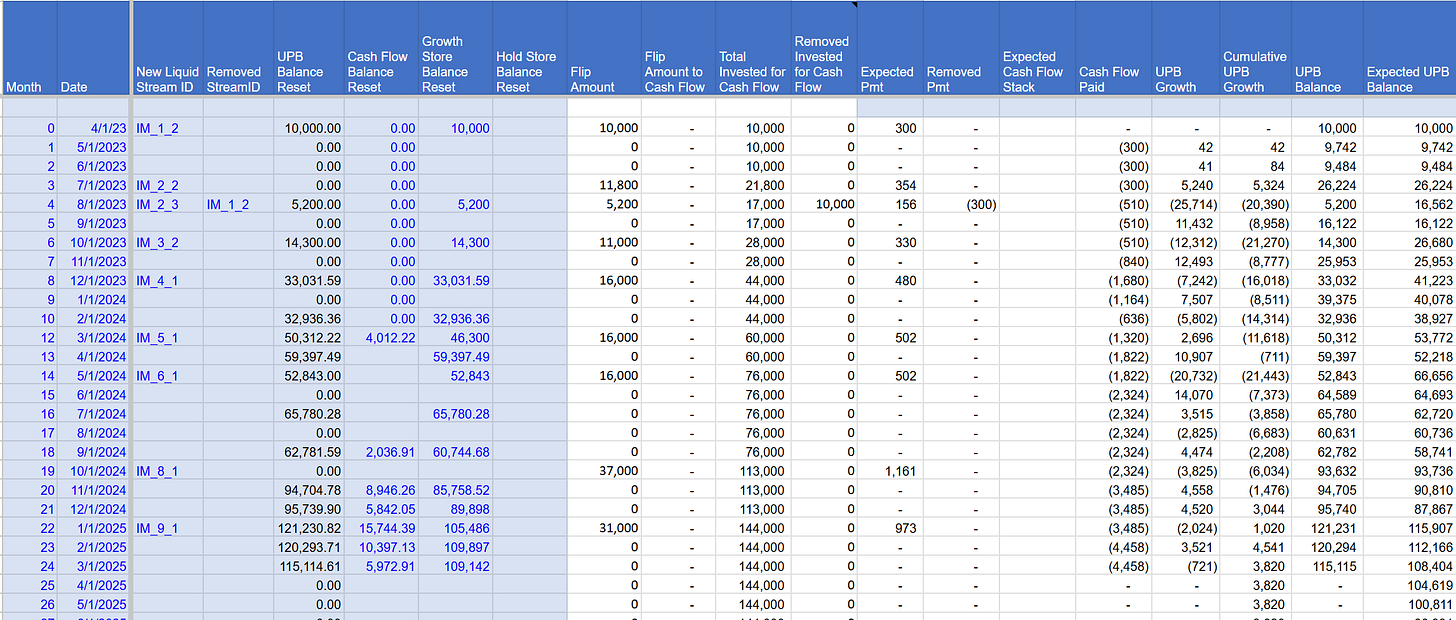

Unpaid Balanced Tracking

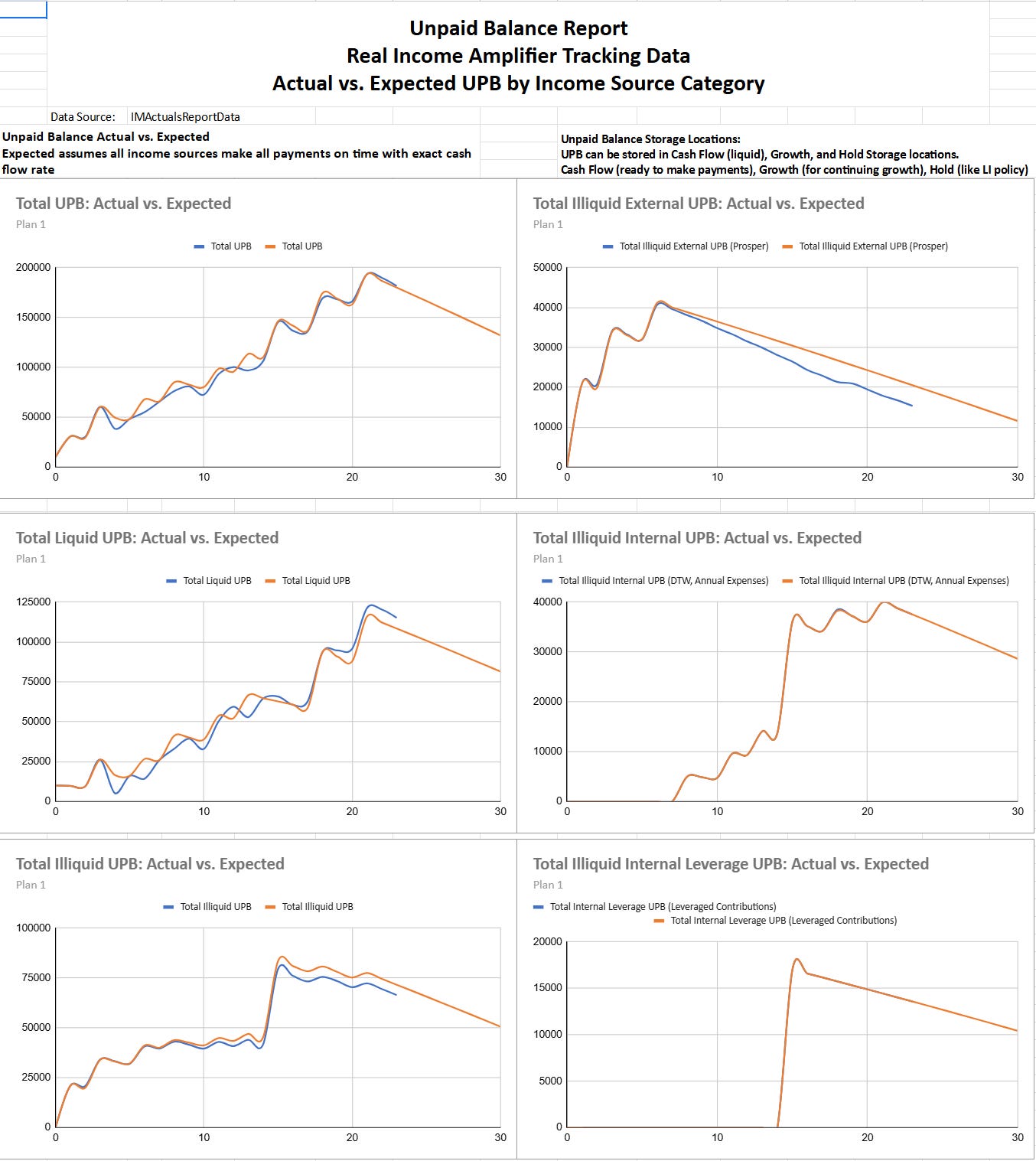

The actual and expected unpaid balance (UPB) is tabulated, so you can see the UPB stack

UPB is tracked in categories:

External-Liquid (like Income Funds)

External-Illiquid (like Prosper)

Internal-Liquid (not applicable)

Internal-Illiquid (like Debt to Wealth)

Internal-Leverage (subset of Internal Illiquid, specifically for Debt to Wealth used to pay interest on leverage contributions and boosters)

Cash Flow Tracking

The actual and expected cash flow stacks from your income sources

Actual and expected payments, cash flow rate, and cumulative cash flow by income source category (external/internal/liquid/illiquid, etc.)

Some income source comparison data, e.g., finding refinance opportunities

Additional Unpaid Balance Tracking by Category

Complete tracking of actual UPB balances by category. For example, M1 and Prosper balances change based on markets or rates or defaults, etc. So you can see if your UPB is above or below what you would expect if payments and balance changes were proceeding perfectly.

Unpaid Balance Report - Model vs. Actual

Unpaid balance model vs. actual chart

Unpaid balance by income source category model vs. actual charts

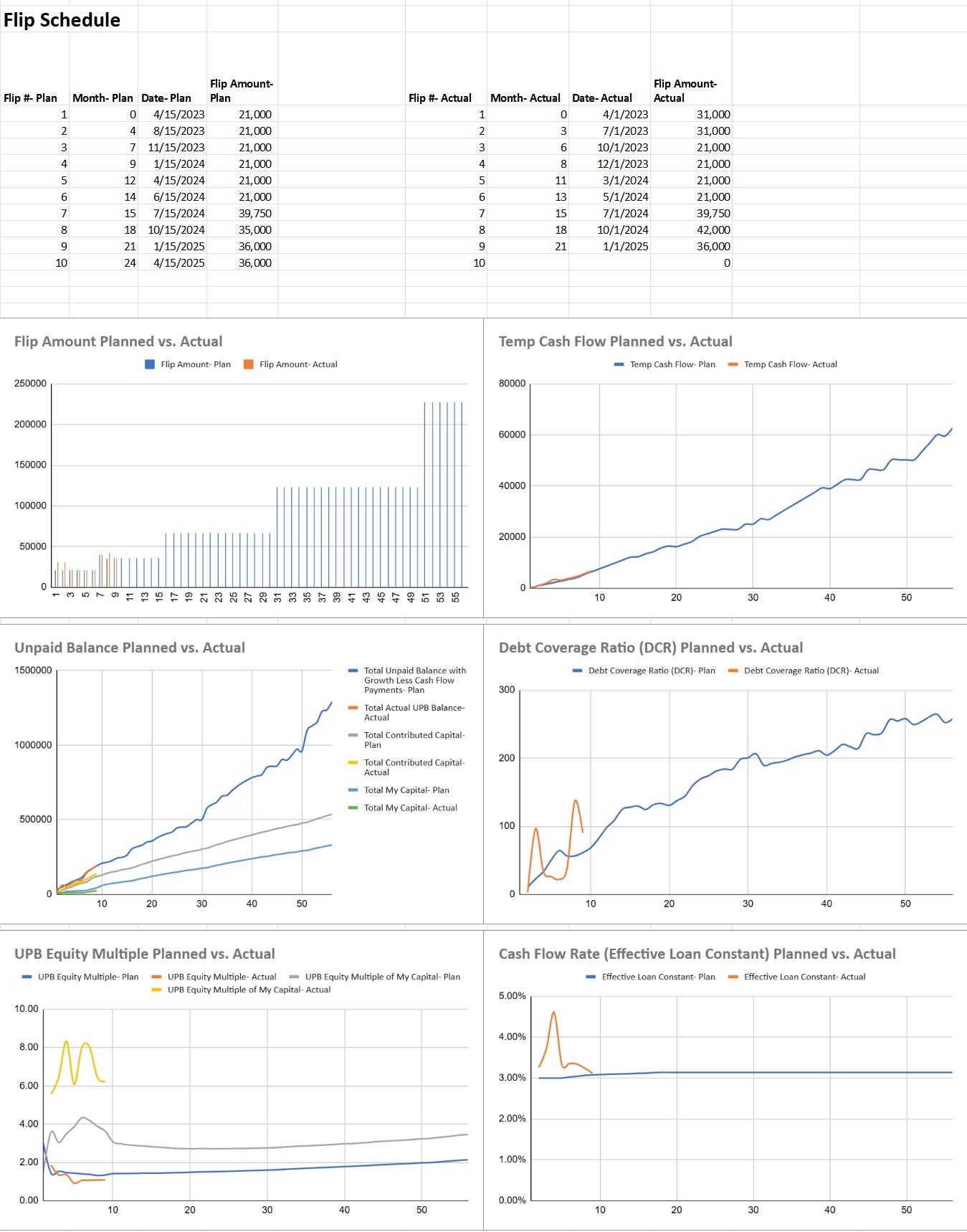

Flip Schedule Report - Model vs. Actual

first 10 flips: date, month number, and amount

Model vs. actual charts for flip amount, temp cash flow, UPB, debt coverage ratio, cash flow rate, and equity multiple

I'd love to get access to the spreadsheet if possible.