How to Beat Inflation with More Ease and Less Risk

Wealth Building Mechanics Part 1

One of the most common problems investors have to solve is beating inflation. For our purposes, we define inflation as the loss of purchasing power of our money. We see this in terms of rising prices for the things we need to buy, like food, shelter, energy, household goods, cars, and everything else we need for our lifestyle. What we mean by beating inflation is that we want to grow our ability to buy whatever we need and want even though prices are going up.

The most common strategy we are taught is to find investments that gain faster than the inflation rate. To do that, we need to know the rate of inflation so we can aim for an investment that has a better rate of return. We could use the reported inflation figures from the Federal Reserve or the government, but given the motivations to underreport, you might decide to look elsewhere. Your personal inflation rate depends on what you tend to buy. I use a rate between 6% and 10% for my calculations. Sometimes inflation is much more and sometimes it’s less.

The other half of the strategy is to purchase assets that actually grow faster than the inflation rate you determined for yourself. If your inflation rate is more than 6-10%, then we’re saying we need investments that return more than 10% every year. We need 15% every year to grow 5% annually (14 years to double your money, using the rule of 72). That’s too hard to do consistently, year in, year out for even experienced investors.

No Risk, No Reward Is a Lie!

When we raise this issue, our industry professionals explain that we have to take more risk to get more reward. Without a better answer, we seem to be caught between swinging for the fences or accepting slow growth that will never be enough.

The risk-reward model is a false choice. It is possible to beat inflation without relying on high-risk investments. Let me show you how:

There is a secret formula - it’s not really a secret, but it’s not commonly discussed.

B = M * I / (1 - R)

B = your breakeven investment rate of return - the rate at which your purchasing power will be maintained by your investment

M = percentage of capital that is yours (0.00 to 1.00 - the remainder of the capital is strategic debt)

I = your inflation rate

R = your effective tax rate - this is the calculated rate of the taxes you paid after all deductions, tax strategies etc. It’s not necessarily the same as your income tax bracket. You might need to discuss with your tax accountant if you don’t know what your effective tax rate is.

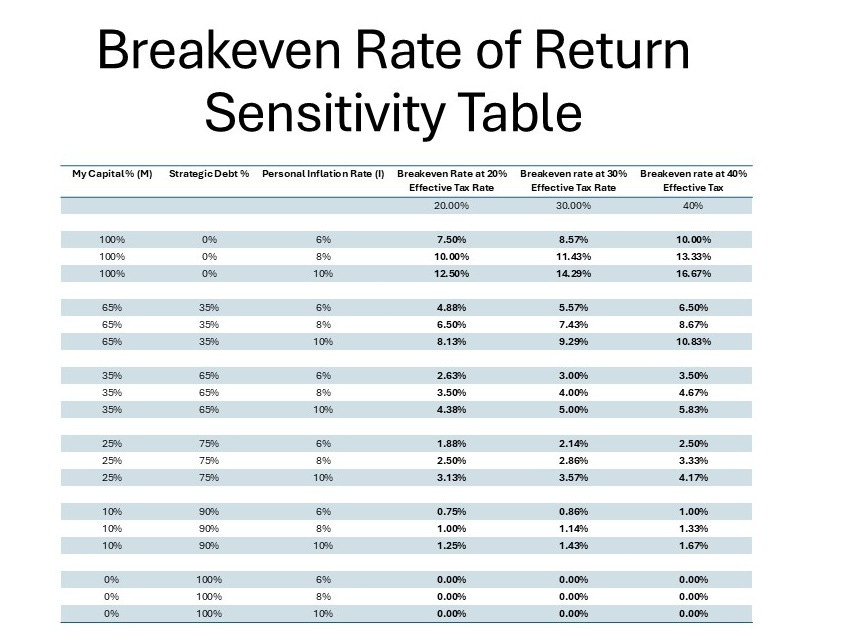

Below is a sensitivity table showing the breakeven rate of return required to maintain your purchasing power given varying inputs:

percentage of capital that’s yours (varies from 100% to 65% to 35% to 25% to 10% to 0%)

personal inflation rate (varies from 6% to 8% to 10%)

your effective tax rate (varies from 20% to 30% to 40%)

Here’s what to notice in the chart:

The highest required returns are in the far right column, using 100% your own money.

The lowest required returns are the bottom three scenarios of all 3 right columns, using none of your own money.

All the values in the middle sections use some strategic debt.

Using Strategic Debt Passes Inflation Effects to Your Lender

Intuitively, it makes sense. The effects of inflation are on the whole investment (your capital and the strategic debt, if any). When you sell an investment you bought with debt, you pay the lender back and pass the effects of inflation on their money back to them. The effect of inflation that you bear is only on your money invested. As a result, the required return for you to break even is only for the amount you invested. If you have used debt, then the required return is less than if you had not used any debt.

As a concrete example, if you buy a rental property with 100% cash (your own money), then your required return to break even is between 7.5% and 16.67%, given the parameters of this chart.

If you buy that same rental property with 25% down and a 75% mortgage and the other variables for inflation and taxes from this chart, then your required breakeven return is between 1.88% and 4.17%.

Again, these numbers are just to break even for an investment with these parameters.

Two more important points:

None of the scenarios using 100% your money (no debt) have a breakeven less than the inflation rate with the given effective tax rates

If you use 65% of your own money, and your effective tax rate is 40%, then your breakeven return is greater than the inflation rate

The conclusion is you can grow your wealth using investments that have lower risk and lower volatility. Your assets don’t have to grow faster than inflation necessarily. To grow wealth faster than inflation and taxes are dragging you down, you need at least some strategic debt in your portfolio.

Three Essential Tools for the Savvy Wealth Builder

And that reveals two essential tools for the savvy wealth builder to explore and master:

Learn to manage debt strategically and safely

Build your access to credit that is appropriate for the kinds of investments you want to do

Notice any fears, anxieties, or anger you have about debt

If you have had bad experiences with debt or have learned that debt is bad or should always be paid off as soon as possible, this is the time to explore more. You can learn about different kinds of debt, when to use them, how much to use, what kinds to avoid, how to keep yourself safe and so on. Debt is neither good nor bad. It is a tool.

One of the best books I’ve found for learning about strategic debt is the following book by George Antone. I have read the book over and over, and I have taken his courses in person.