When I Hear, "The Only Way to Build Wealth Is..."

I find more ways to build wealth!

I’m not really a contrarian or a rebel all the time. I just like things to make sense, and there’s a lot of advice about wealth building out there that sounds good but is incomplete or misleading.

Now I’m going to pick on a talented analyst and investor, Lyn Alden - not because I think I’m smarter - but simply because I cherry-picked one post of hers that I will use to illustrate the point of this article. (Sorry, Ms. Alden!)

How to Build Wealth Fast (?)

In the post, How to Build Wealth Fast- This Chart Shows What it Takes, she provides a chart of monthly savings amount vs. rate of return to show how much wealth can be built in 25 years. In the section that follows, How to Build Wealth, she declares that there are two things to get right to build wealth:

Increase the difference between your income and expenses

Save that difference and grow it exponentially over time

That’s it.

When I first read this, I thought, “Sounds right, but I’m not totally convinced… ” (and also “25 years isn’t very fast!”

Declarations Invite Contrarians

When we declare there is only one way to do something, we also invite contrarians to search for new possibilities. I probably wouldn’t have given her comments a second thought if I hadn’t already found other contrarians and rebels who see the problem differently and have found new ways to approach the problem of wealth building.

If a declaration doesn’t trigger some curiosity and creativity, then you might just accept it without question. But if you take in a broad range of view points from many people, many sides, and many domains, you may be more likely to trigger your built-in creativity see a challenge with different eyes.

There are two ways of seeing the wealth building challenge that may change the way you think about solving the problem.

Acknowledging the magnitude of the wealth building challenge we face

Seeing and changing the flow of money through your life

The Magnitude of the Wealth Building Challenge

I discussed the magnitude of the wealth building challenge in the series, “Simple Model for Building Wealth.”

To summarize, the fundamental problem is that most of us simply can’t save enough money fast enough to have enough assets to generate the passive income we need for our lifestyle.

Salaries don’t grow fast enough, and they usually level off mid career

Life expenses keep growing as fast or faster than our incomes

We are told that we have to save more and more, but we are squeezed to a pulp. There is just not enough margin for most of us to save and get ahead of inflation.

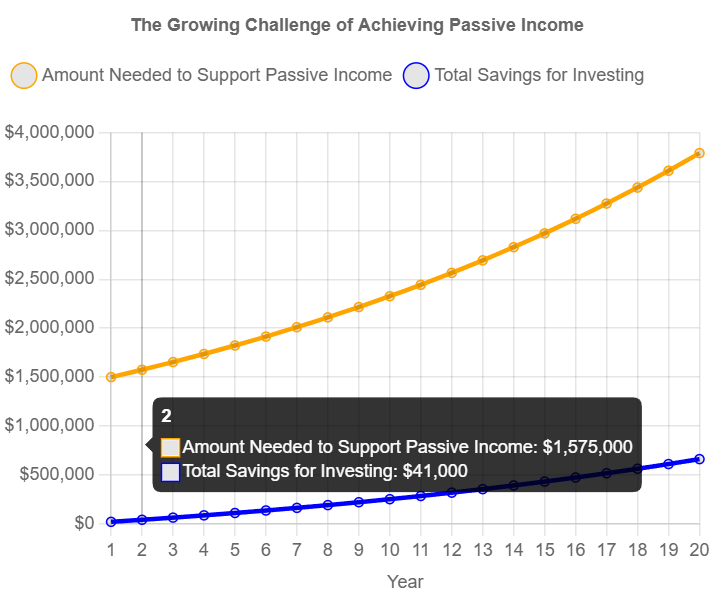

For most of us, the numbers are not just daunting; they are stupefying. To see your own numbers for yourself, I invite you to see a tool at Fynanc.com that explains this challenge. They call it the Compounding World problem, which refers to the fact that our lifestyle expenses continue to compound with inflation, but our savings tops out and is essentially flat. Without sufficient compounding of your savings and investments, the finish line speeds ahead much faster than we can run.

Here’s a sample chart from the tool with sample inputs:

Desired annual passive income: $120,000 ($10,000 per month)

Current annual salary: $80,000

Expected annual salary increase: 5%

Annual inflation rate: 5%

Average portfolio annual yield: 8%

Percentage of your income that you invest: 25%

See the problem? The gap between compounding investments and the goal is increasing even with salary increases and saving 25% of income.

Here’s the link to the Compounding Problem of Achieving Passive Income

https://toolbox.fynanc.com/compounding

I encourage you to try it out for yourself to get a view of your own finish line and the challenge you face to reach it.

When the Horse Is Dead, Dismount

After I lost my job by surprise in 2014, I believed a good salary, along with my wife’s good salary, was still not going to be enough for us to make up the ground we needed. At the time, we were in our mid forties. In addition to needing to make up ground on a finish line speeding ahead, we also had to dig out of a giant hole from debts from a challenging business, student loans, a rental property losing money… We weren’t even saving money yet.

Believing that the paths I had already tried were certainly not going to work, that predicament led me to look for other ways forward. That doesn’t mean it was clear, easy, or flawless. It just meant I was genuinely committed to learning ways to make up ground and get ahead somehow, some way by not relying on what I had already tried..

The Flow of Money through Your Life

In Ms. Alden’s post, the approach for building wealth fast is much like the conventional point of view and makes no suggestion for other avenues. The overall strategy is then

Save as much as you possibly can every month after you pay your expenses.

Invest it with the best possible rate of return you can find.

This leads many to believe that this is the best we can possibly do. After acknowledging the magnitude of the challenge, we either resign to working until we cry uncle because we believe the dream goal is impossible, or we start thinking about paths we’ve never tried before.

Many people reach their financial goals, so it must be possible to succeed. But it’s common to believe that we won’t succeed unless we have a serious head start, like we imagine others must have had. I’ve heard some say, “The only way to get a home now is to inherit it.” Well, it might be harder for most people to do it the way it used to be done, but maybe that invites us to look for new possibilities. Will you accept the invitation?

Possibility 1: How could money flowing into your life contribute to your compounding before it goes out?

We are taught to save after we pay expenses. What if we could make money or reduce expenses during the time we have received money but before we have to send it out?

There are many techniques for this, depending on how long you have the money, how much you receive, what banking tools and processes you use, and so on. It’s possible to make money or save money just by the way you guide money to flow through your life. It’s a matter of finding tools, techniques, and processes that many people already know how to use.

Possibility 2: How could you compound your savings quickly with modest returning, low-volatility assets?

We are taught that the only way compounding happens is by investing and then reinvesting returns. That is, we know no other way to create compounding besides investing and waiting for the growth (and then sale) or income (rents, dividends, etc.), and then reinvesting.

There are more ways to create and control compounding for yourself. Some ideas were given in these two recent posts:

Expanding Your Ways to Get Ahead

Recycling Capital Accelerates Your Wealth

There are many ways to use leverage and recycling capital (velocity of money) to get more compounding for your savings and investments. I would never have found them if I had not kept asking questions and found people searching for better solutions.

The theme for the annual conference for the Fynanc community was “Bend the Line.” Look again at the graph above. Imagine the blue line of your savings compounding so fast that your blue line of investments bends upwards and exceeds your finish line in less than 10 years and then stays ahead for the rest of your life. Not only this possible, everyone in this community is doing it now. We are bending our lines!

My Secret (not really a secret!)

If I have any secret to offer, it is that I never stop challenging what I know and never stop learning even when I hear pretty good answers from very smart people. There is always more I can learn, and sometimes I create breakthroughs that can change my life. I invite you to keep challenging yourself. Don’t let what you know keep you from seeing opportunities to bend your line and change your life.